What is Trade Finance?

Trade Finance has been reviewing the global trade and export finance markets since 1983 and what constitutes trade finance has gone from a basic letter-of-credit product to highly structured combined bond and debt financing.

What is trade finance?

There are various definitions to be found online as to what trade finance is, and the choice of words used is interesting. It is described both as a ‘science’ and as ‘an imprecise term covering a number of different activities’. As is the nature of these things, both are accurate. In one form it is quite a precise science managing the capital required for international trade to flow. Yet within this science there are a wide range of tools at the financiers’ disposal, all of which determine how cash, credit, investments and other assets can be utilised for trade.

In its simplest form, an exporter requires an importer to prepay for goods shipped. The importer naturally wants to reduce risk by asking the exporter to document that the goods have been shipped. The importer’s bank assists by providing a letter of credit to the exporter (or the exporter’s bank) providing for payment upon presentation of certain documents, such as a bill of lading. The exporter’s bank may make a loan to the exporter on the basis of the export contract. The type of document used in the process depends on the nature of the transaction and how evidence of performance can be shown (i.e. bill of lading to show shipment). It is useful to note that banks only deal with documents and not the actual goods, services or performance to which the documents may be relating to.

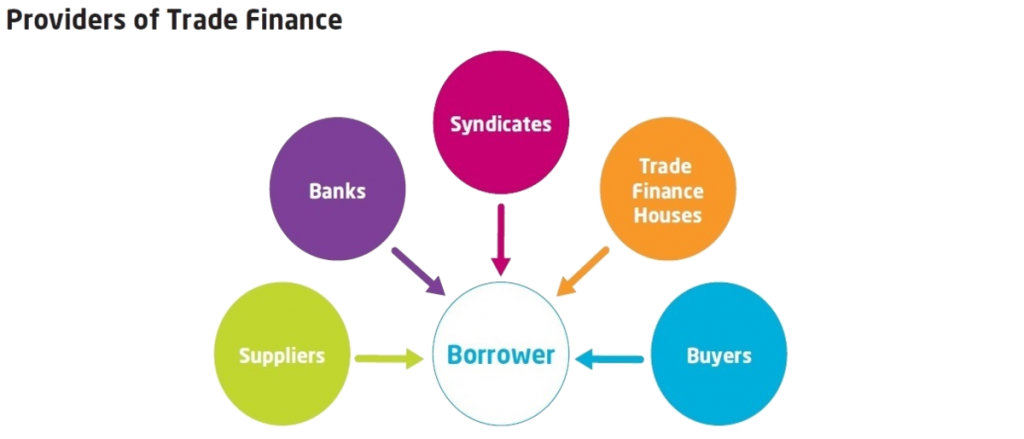

Trade finance is used when financing is required by buyers and sellers to assist them with the trade cycle funding gap. Buyers and sellers also can also choose to use trade finance as a form of risk mitigation. For this to be effective the financier requires:

– Control of the use of funds, control of the goods and the source of repayment

– Visibility and monitoring over the trade cycle through the transaction

– Security over the goods and receivables

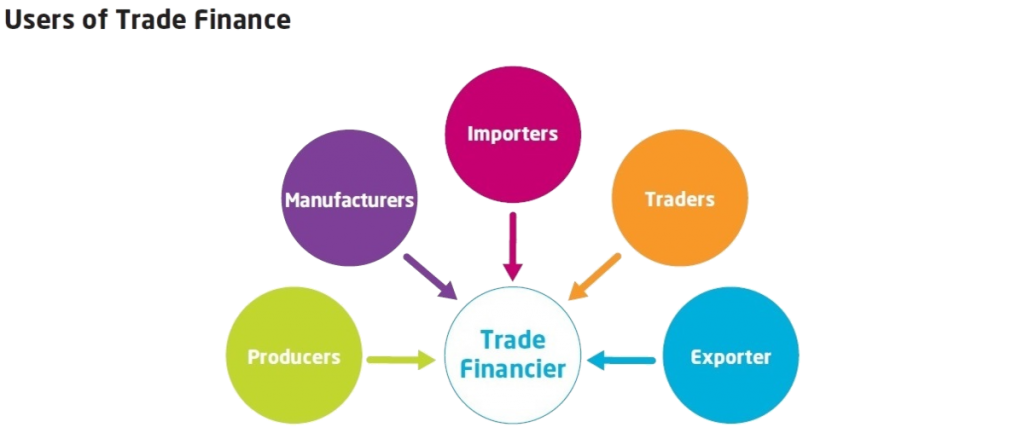

Trade finance helps settle the conflicting needs of the exporter and the importer. An exporter needs to mitigate the payment risk from the importer and it would be in their benefit to accelerate the receivables. On the other hand the importer wants to mitigate the supply risk from the exporter and it would be in their benefit to receive extended credit on their payment. The function of trade finance is to act as a third-party to remove the payment risk and the supply risk, whilst providing the exporter with accelerated receivables and the importer with extended credit.

Trade finance is a large industry and covers many various sectors whereas the description above only explains ‘traditional trade finance’. We provide best and perfect solution for your trade financial need.