Project Finance, Working capital finance, Corporate finance, External Commercial Borrowing, Business Funding, Trade Finance, Equity/Venture capital, Foreign Direct Investment, Global Trade Finance, Foreign currency term loan

Overseas Finance Management & Project Consultant

Moneymec has worked directly on behalf of private companies seeking debt/equity/project financing from export credit agencies, grant making agencies, private sources of capital and funds for purposes of privatization, restructuring or start-up capital. Moneymec’s consulting work dovetails with financing efforts as in the identification of strong development opportunities for international finance institutions.

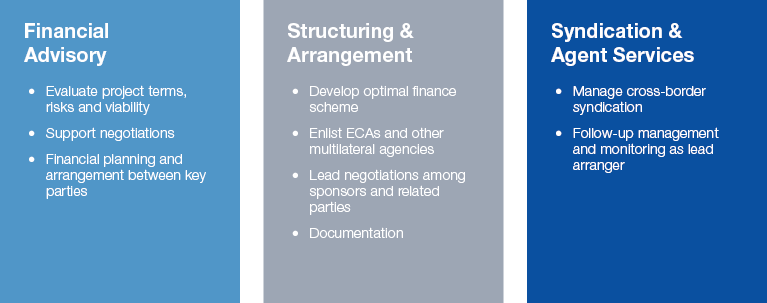

FINANCIAL ADVISORY

We help our clients in all aspects of financing their long-term investments. Our team provides services in advisory and financial modeling to help the client undertake their projects with the best information and most accurate forward projections. We act as a partner/mediator to the client throughout the project finance process, and maintain their objectives and priorities through the financing.

Our team is made of former project finance bankers and experienced infrastructure and energy finance professionals with a deep understanding of the challenges related to raising limited recourse project financing in the sectors and markets in which we are active.

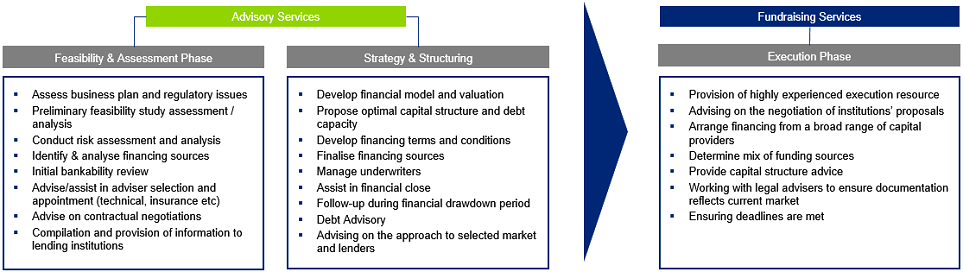

WE ADVISE OUR CLIENTS THROUGHOUT THE CAPITAL RAISING PROCESS

Moneymec often gets involved at the earliest stages of project development or at bid stage to support our clients during the negotiation of the projects’ contractual frameworks to ensure that the proposed commercial arrangements are conducive to implementing an optimal financing package in the context of a limited recourse financing strategy.

360-Degree Approach to Financial Advisory

PROJECT DEVELOPMENT

*Bid Stage Advisory *Contractual Framework *Design Permitting Process Review

DEBT STRUCTURING

*Financial Modeling *Market Read *Bank Due Diligence & Credit Approval

EXECUTION

*Support throughout Documentation *Derivatives Pricing Benchmark *Deal Monitoring

Case studied/Interested sectors

Real Estate Development, Infrastructure development, Hotel Industry, Tourism & Hospitality services, Healthcare & pharma , Oil & natural gas, Renewable energy, Steel & cement, Education, Manufacturing & trade